On November 7, an Agreement between the General Administration of Customs of the People’s Republic of China and the Israeli Tax Authority regarding Mutual Recognition of the Enterprise Credit Management Program in China’s Customs Authority and the Authorized Economic Operator Program in Israel’s Customs Authority was signed in Beijing.

Sitting at a strategic point between Asia and Europe, Israel is a key participant in the Belt and Road initiative and one of the most important trading partners China has. From January to October of 2017, the gross import and export value of trade between the two nations totaled RMB 88.672 billion, growing by an astounding 69.59% YOY.

In order to enhance bilateral trade and customs cooperation, negotiations between the two customs agencies were launched in early 2014. A number of working group meetings were held in May 2014, September 2016 and again in May of 2017. Both sides exerted considerable effort to complete their work on AEO program comparison, field validation and observation as well as negotiations on facilitation measures, and electronic data exchange, which eventually lead to the signing of the AEO MRA.

AEO is the abbreviation for “Authorized Economic Operator”. Advocated by the World Customs Organization (WCO), the AEO program is a system that requires customs authorities to evaluate the status of corporate compliance, credit and security and facilitate customs clearance accordingly. Through AEO mutual recognition, one country’s customs administration could offer facilitation measures to companies who are members of the others’ AEO Program, so as to enhance the efficacy of customs clearance between the two nations, thus shortening the time needed for clearance and by extension lowering the associated trade costs.

Since the AEO program was introduced back in 2008, the AEO Program has been developed into a full-fledged system, which has enabled China Customs to be at the vanguard of the international customs in AEO mutual recognition. So far, the China customs authority has reached an AEO MRA with 34 national and regional customs administrations, including the EU, Singapore, The Republic of Korea, Switzerland, New Zealand, Israel as well as Hong Kong SAR. According to statistics, the inspection rate was reduced by 60-80 percent, and the time and clearance costs were reduced by over 50 percent when products from domestic AEO companies were exported to the above-mentioned countries and regions.

Currently, China Customs has been engaged in negotiations on AEO MRAs with customs authorities for countries along the Belt and Road route including Russia, Kazakhstan, Malaysia, Turkey, Mongolia as well as important trading partners like the United States and Japan. China Customs hopes to reach AEO mutual recognition with all countries along the Belt and Road that wish to take part by 2020.

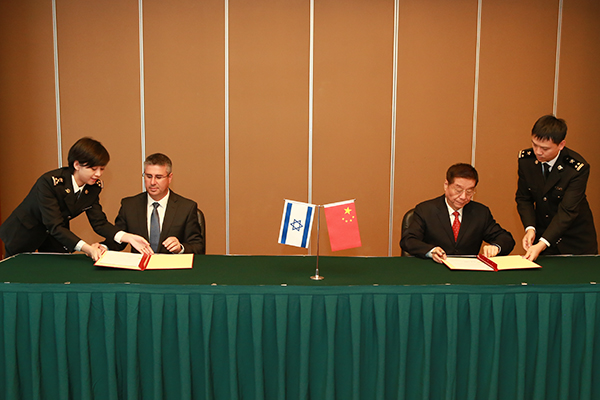

Minister Yu Guangzhou and Director General of the Israeli Tax Authority

sign the AEO Mutual Recognition Agreement

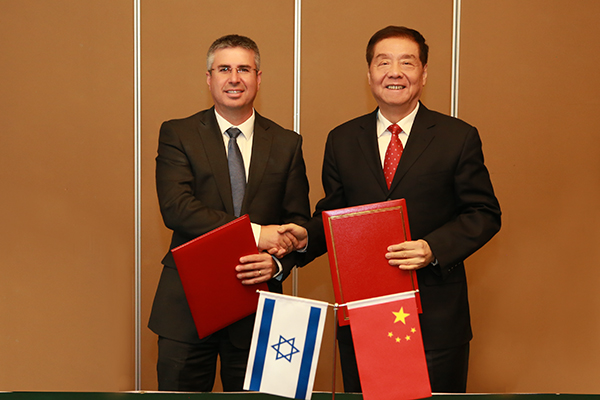

Minister Yu Guangzhou and Director General of the Israeli Tax Authority

sign the AEO Mutual Recognition Agreement

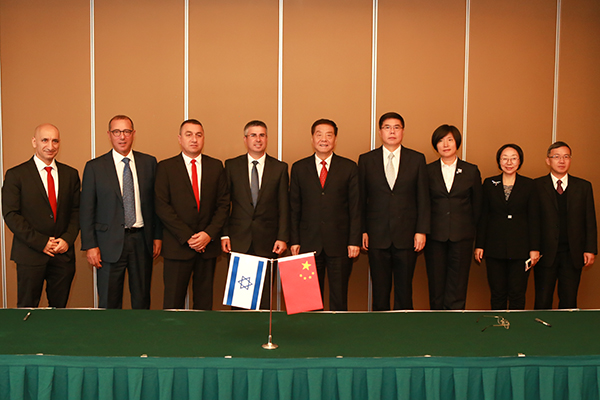

Minister Yu Guangzhou and Director General of the Israeli Tax Authority

sign the AEO Mutual Recognition Agreement